- AUTHORInsurance retreat and climate change: Much-anticipated research released

- December 2 2020

Insurance retreat and climate change: Much-anticipated research released

In her much-anticipated Deep South Challenge research report, Insurance Retreat, Belinda Storey (Climate Sigma) attempts to look to the future, to ask how the insurance sector will respond to the ever-increasing impacts of climate change.

Within our four largest cities, at least 10,000 houses currently sit within a 1-in-100-year coastal flood zone. Nationally, around 450,000 houses are within 1km of the coast. These homes are likely to be affected by more frequent and intense storms and by sea level rise. One reason is that sea level rise allows storm surges to reach further inland.

Just 10cm of sea-level rise in Wellington, for example, will change the probability of a flood event by five times. That is, an event that might have occurred once every 100 years will soon occur every 20 years. But worsening coastal hazards are not yet fully reflected in homeowners’ decisions to purchase, develop or renovate coastal property. New Zealand is also still building new residential developments in climate-risky locations.

“People tend to be very good at ignoring low-probability events,” Storey says. “This has been noticed internationally, even when there is significant risk facing a property. Although these events, such as flooding, are devastating, the low probability makes people think they’re a long way off.”

But how are insurance companies in Aotearoa New Zealand likely to respond? Will they be as relaxed about risk as homeowners? That’s unlikely.

International experience and anecdotal evidence from those in the industry suggest that companies start pulling out of insuring properties at around 2% AEP. By 5% AEP, insurance is completely unavailable. That is, insurance companies withdraw insurance from an area when disasters (like floods) begin to occur between every 50 to 20 years. This is probably a conservative estimate.

If the probability of your hazard increases five-fold, from 1% to 5% AEP, your premium and/or excess will go up and you’ll find it increasingly difficult to renew your insurance for that hazard.

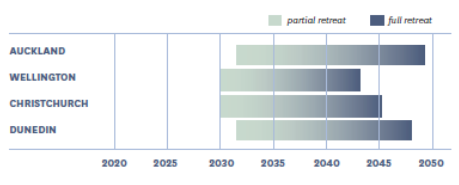

In this research, Storey analyses extreme sea levels for the Auckland, Wellington, Christchurch and Dunedin coastlines. Her findings indicate that homes that might currently flood only once every 100 years are likely to experience insurance retreat over the next 15 years:

To accompany the release of this research, the Deep South Challenge has published an accessible factsheet for homeowners, “Your Questions Answered: House Insurance & Climate Change.”